Miért a Moby? - Kiválóság a biztosításban

Hiszünk abban, hogy a biztosítás működtethető teljesen automatizált rendszerben. Ahol az emberek feladata nem a napi működés biztosítása, hanem az újszerű termékek kifejlesztése.

Az üzleti partnerei Önnek dolgozhatnak. Adja meg nekik a lehetőséget!

A Moby egy nyitott rendszer. Az üzleti partnerei összekapcsolhatják vele saját rendszereiket webservice-eken keresztül.

Automatizálja folyamatait!

Hiszünk abban, hogy a biztosítási üzlet működtethető az idegölő manuális teendők nélkül. A Moby segít ebben.

Speciális üzleti szegmensek kiszolgálása

A Moby rugalmasan alakítható. Célba vehetők segítségével az eddig elérhetetlen, speciális üzleti szegmensek.

Gyors piacra lépés

A Moby olyan eszköztárat biztosít, amivel nagyon gyorsan piacra lehet vinni új termékeket.

7x24

Az üzlet éjjel-nappal megy. A Moby sem pihen. Olyan feldolgozási folyamataink vannak, amik biztosítják a 24 órás nyitvatartást.

Alacsony költségszint

A Moby használata mellett nem kell kiegészítő licenszeket vagy speciális hardvert beszerezni. Felhőből is igénybe vehető.

Mi ez az IaaS, Insurance as a Service?

Kinek jó ez a megoldás?

Moby modulok

Az alkalmazás egyes moduljai önálló egységeket alkotva a biztosítói szakma egy-egy részterületének feladataira nyújtanak megoldást.

Partner

Partner modul

A Partner Modul a rendszer szinte minden más komponensével kapcsolatban áll, hiszen ebben kerülnek letárolásra a partnerekkel kapcsolatos adatok, legyen szó szerződéseken szereplő biztosítottról, kárügyhöz kapcsolódó kárszakértőről, vagy akár magukról a rendszer felhasználóiról. Az adatok minőségének megőrzését a validációs keretrendszer által futtatott validációk biztosítják.

Ajánlat / Szerződés

Ajánlat / Szerződés modul

A Moby Ajánlat / Szerződés Modulja teljeskörű szerződéskezelést biztosít, ami magában foglalja a szerződés díjának kalkulációját, a szerződések adatainak ellenőrzését (validációk), valamint a szerződések teljes életciklusának támogatását (díjkínálat - ajánlat - szerződés, verziózott adattárolás).

A Szerződés Modulban kialakított termékek kalkulációi, nyomtatványai és validációi alapértelmezés szerint webservice formában is előállnak, megkönnyítve ezzel az integrációt a partnerek rendszerei felé.

Az egyes biztosítási termékek specifikus adatainak és folyamatainak kezeléséhez a keretrendszer testreszabása szükséges. Ezt nagymértékben megkönnyíti a Moby Konfigurációs Modulja, amely széleskörű paraméterezhetőséget biztosít a teljes rendszer számára, ezáltal lehetővé válik egyszerűbb biztosítási termékek akár fejlesztés nélküli bevezetése is.

Ügykezelés

Ügykezelés modul

A Moby Ügy Modulja általános ügykezelést tesz lehetővé. A legjellemzőbb adatok (kapcsolódó partnerek, címek, bankszámlaszámok, stb.) megadásán túl lehetőség van ügytípusonként eltérő mezők fejlesztés nélküli konfigurálására és használatára, valamint ügyek közötti hierarchikus kapcsolatok megadására is.

Az Ügy Modul a Feladatkezelő Modul folyamatmotorjával szorosan együttműködve egyedi folyamatok kialakítására is lehetőséget ad. A felhasználók dedikált munkakosarukon keresztül érhetik el a nekik kiosztott feladatokat.

Kár

Kár modul

A Kár Modul által támogatott termékek és kártípusok köre igény szerint rugalmasan bővíthető. A kárkezelési folyamat részeként lehetőség van fedezetellenőrzésre, formalevelek generálására és kiküldésére, tartalék képzésére és a tartalék terhére történő, többszintű jóváhagyási folyamattal támogatott kifizetésre, szakértői feladatok kiosztására és nyomonkövetésére. A Konfigurációs Modul segítségével rugalmasan paraméterezhetők a károk és a részkárok típusai, a kötelezően elvárt dokumentumok, az egyes fedezetekhez tartozó károkok és veszélynemek, a kifizetések során figyelendő limitek, valamint az egyes fedezetekhez engedélyezett kifizetési jogcímek is.

Jutalék

Jutalék modul

A Pénzügyi Modul kiterjedt jutalékkezelést biztosít. A jutalékszámítás alapértelmezetten fix és százalék típusú jutalékszabályokkal dolgozik, legyenek azok egyszeri vagy folytatólagos jutalékok, de a szabályok termék, módozat, üzletkötő, értékesítési csatorna vagy akár egyedi szerződés szintjén is paraméterezhetők. A felhasználó rugalmasan definiálhatja azt is, hogy milyen jogcímekre történjen a jutalék tételek kifizetése, mi legyen a számítás alapja, de rendelkezhet a jutalék előírásának, kifizethetőségének, visszaírásának, valamint továbbosztásának feltételeiről is. A jutalékzárás tetszőleges időszakra és jogcímre elvégezhető, egy záráson belül pedig üzletkötőnként állítható, hogy mely tételek kerüljenek ténylegesen kifizetésre.

A zárások jóváhagyását a Moby jóváhagyó motorja szabályozza. A jutalékkezelés funkciók mind a biztosítói, mind az alkuszi működést képesek kiszolgálni.

Pénzügy

Pénzügy modul

A Pénzügy Modul felel a díjak előírásáért, a számlák, a bejövő és kimenő pénzek kezeléséért, valamint a főkönyvi zárásokért. A kifizetéseket a Moby jóváhagyó motorja szabályozza.

Ügyfélkommunikáció-menedzsment (HAMMY)

Ügyfélkommunikáció-menedzsment (HAMMY)

A Moby kiterjedt belső és külső kommunikációt tesz lehetővé. A teljes körű email támogatásnak köszönhetően akár külön email kliens használata is mellőzhetővé válik az ügyintézők számára. A levelek kiküldését és a visszapattanó levelek kezelését a DBX elektronikus kommunikációs megoldása, a Hammy végzi.

A Hammy legfontosabb jellemzői:

- Sokcsatornás ügyfélelérés

- Sablon alapú dokumentum generálás

- Elektronikus dokumentumtár

Ügyfeleink

Ügyfeleink mondták

"Új márkát építünk, újszerű, innovatív termékekkel. Ehhez rugalmas core rendszerre van szükségünk."

Kerepesi Károly

Igazgatósági tag – Postabiztosító, Hello márka

"Célunk egy szervíz orientált IT architektúra építése. Ennek az építkezésnek egy kiváló építőeleme a Moby."

Kerepesi Károly

Operációs és IT Igazgató, AEGON Magyarország

2025.09.26. 17:01 | Kovács Ágnes

FBAMSZ konferencia 2025 - beharangozó

📢 Ismét ott leszünk mi is a FBAMSZ konferencián:

📆 2025.09.30-10.01.

👉️ Székely Sándor 📍 Insurtech Híradó ⏲️15:00-15:25, 🎯 nagyterem.

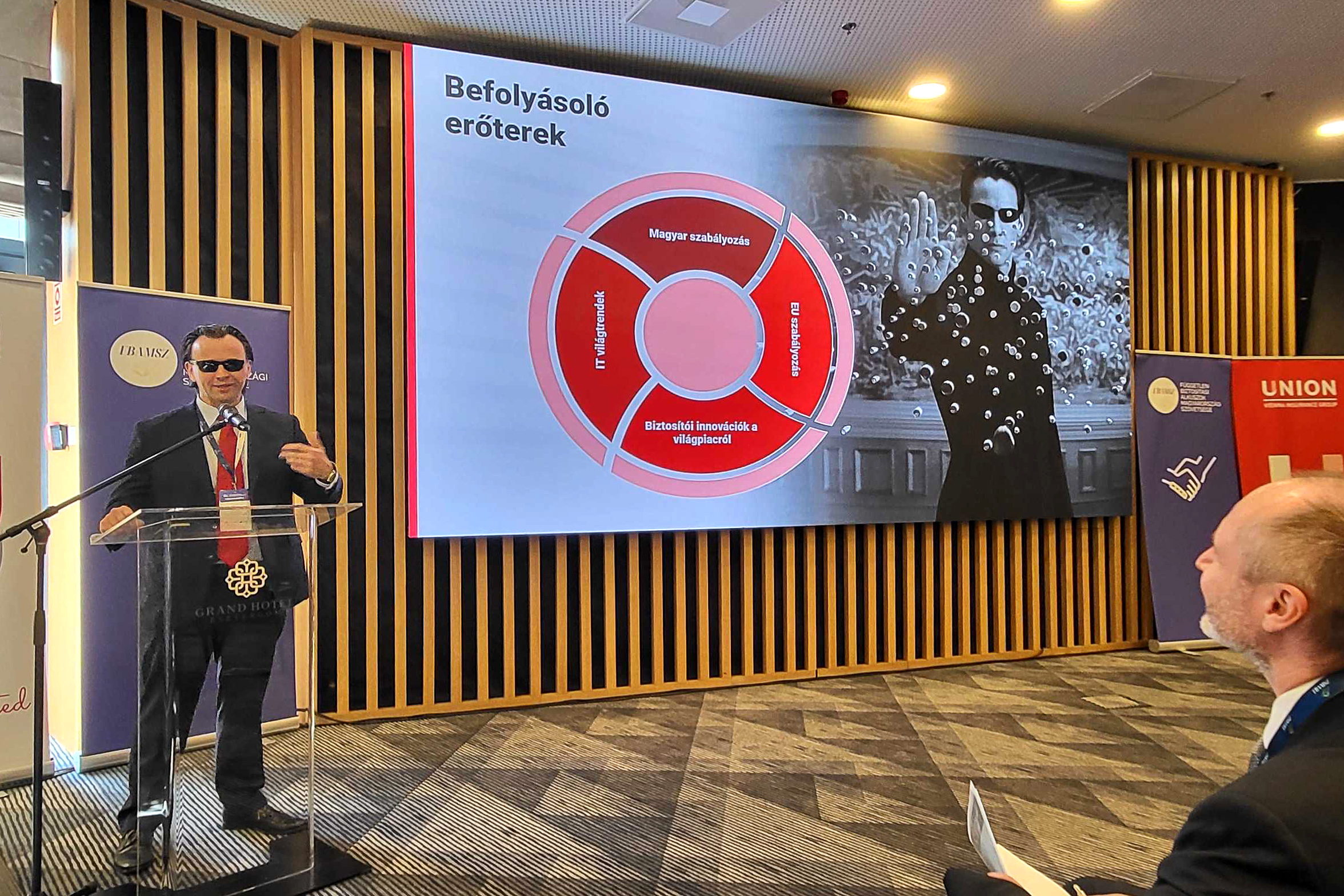

2024.10.10. 11:19 | Székely Sándor

DBX részvétel a 2024. évi FBAMSZ konferencián

Idén immár másodszor találták meg az alkuszok és a biztosítók szakemberei a DBX standját az esztergomi FBAMSZ konferencián, viszont Székely Sándor (tulajdonos - ügyvezető) insurtech szakértőként most már a nagyteremben tartott érdekfeszítő előadást a résztvevőknek. Ezen az előttünk álló biztosítás-informatikai trendeket és a következő években előttünk álló kihívásokat vette górcső alá.

2024.10.07. 18:42 | Székely Sándor

Fizetési kérelem, qvik: új lehetőségek a Hammy-ben

Mostantól már nem csak az ügyfél elektronikus vagy papíros postaládájába, Messenger vagy Viber fiókjába, SMS alkalmazásába, hanem a mobilbankjába is tud kézbesíteni a Hammy.

A fizetési kérelem a Hammy 3.24.8-as verziójában egy új kommunikációs csatornaként jelent meg.